Three-fifths of organizations are unable to measure whether their AI investment was successful or not. They buy subscriptions, train teams, bring together tools–and have no tangible information on whether it was worthy of the cost.

The article is a practical approach to AI ROI measurement beyond some amorphous cost reduction when delivering returns so much easier to quantify. Appealing AI to a CFO or explaining the expenses of ChatGPT Enterprise last quarter, this calculator-based model creates actual figures.

The evidence demonstrates that, as taken into consideration, the majority of AI applications yield 135-400% ROI in the 1st Year. Its difficulty is in the knowledge of where to search, and what to gauge. To put the choice of the correct tools into more widespread perspective, refer to The Complete Guide to Generative AI Tools for Business.

Why Most AI ROI Calculations Fail (H2)

It is worth knowing why many companies mis-calculate before analyzing the calculators and formulas.

The usual formula is based on this model: we saved 20 hours a week, multiplied it by hourly rate, that is all. It is not an ROI measure that is wishful accounting. Here’s what gets missed:

Overt costs are concealed within the implementation expenses. Teams revolve around subscription packages (ChatGPT Team would cost around $30/month, which is cheap) without considering the cost of integration (which takes at least $15,000), training (which cost at least $8,000), and consultants that setup everything (which cost at least $12,000).

The productivity recession that no one talks about. It has a transition period of 4-8 weeks wherein the output actually declines as the teams acquire new workflows. That is actual expense that hardly gets into spreadsheets.

Difficult-to-quantify advantages. What is the measure of more superior decision-making or more employee morale? Majority of firms do not even bother with it resulting in immense value being left unattended.

The result? OTPS In other words, either over-optimistic forecasts which make AI sound like magic or excessively conservative that cut projects off the ground. Both methods do not facilitate intelligent decisions.

The Four-Pillar ROI Framework

It is more effective to measure AI returns in a better way. Measurement should cover four pillars instead of focusing on one pillar, i.e. labor saving. They represent different items of value and put the entire picture together.

Pillar 1: Financial Returns (Direct Cost Savings)

This is the straightforward type by which one sees hard dollar savings which are reflected in the budget reviews.

The saving in time is calculated in labor reduction. Formula: vs Hours Saved x Hourly rate. Savings of 40hrs/month by automation of campaign briefs is achieved in a marketing team. And at 50/hours blended rate, that is 24,000 a year.

The automation of processes compares the difference between manual and automated processes in terms of costs. Human review of the invoice cost manually is $8 per invoice. AI extracting and reconciliation automated robots it down to 1.50. The processing of 10,000 invoices annually will save 65, 000.

Reduction of cycle time generation generates revenue effects of speedy delivery. The response time of a sales team having an AI proposal generation reduces by 3 days to 4 hours. The fact that it was increased by 67 percent implies that more proposals will be received each quarter, which will be directly translated into completed deals.

Pillar 2: Productivity Gains (Indirect Benefits)

These advantages do not manifest in line budget, but definitely reflect in the bottom line.

Throughput improvement refers to doing more by using the same resources. When a support team has 50 tickets assigned to each agent per day, they will jump to 85 tickets due to the assistance of AI in determining the triage and drafting of responses. It will increase capacity by 70 per cent without recruiting.

Quality improvement lowers the downstream costs. Reduced errors translate to reduced rework, reduced customer complaints as well as decreased returns. By reviewing contracts with AI and identifying 23 percent higher compliance problems at the stage of reading, a legal team will save money on fixing problems later.

The employee contentment is in retention measures. The time and money that is wasted in recruiting, onboarding and lost productivity are up to 50-200 percentage of the salary of an employee when looking at high turnover. AI solutions that can remove manual WebEx enhance retention, at a cost of six figures per avoided departure.

Pillar 3: Business Agility (Strategic Benefits)

This pillar seizes competitive advantages which do not have dollar values at the moment but contribute to future success.

Quicker time-to-market translates to facing off competitors. The timelines can be shortened by 30-40 years with AI driving product development, as the company will be able to occupy a market share sooner.

Better decision making comes up as a result of AI-guided data analysis revealing insights that humans would not have noticed. A retail chain that optimizes inventory with the help of AI decreases inventory outages by 18 percent and abatement of excess inventory by 22 percent.

Competitive advantage is difficult to measure yet it is lost easily. The companies that will learn how to use AI technologies have an accelerated speed, operate more efficiently and react to the shifts in the market much faster than the other firms that remain tied to manual procedures.

Pillar 4: Risk Mitigation (Avoided Costs)

These form the type of catastrophic scenarios that do not occur as AI has already noted it.

Automation of compliance eliminates regulatory fines. The fines imposed by GDPR amount to 4% of annual revenue. AI-controlled data governance that is used to ensure compliance is well beyond its cost.

Fraud detection prevents the occurrence of losses. Fraud detection AI-based financial services show an increase in the rate of fraud detection by 40-60 percent, which saves hundreds of millions of dollars.

Increased security levels minimize risk of breach. Having the average costs of data breaches at 4.45 million, AI-based security monitoring that helps to thwart a single incident returns a hundred times its price.

The Basic ROI Formula With Working Example

The formula is so simple:

ROI % = (Total Benefits- Total Costs)/Total Costs x 100.

This is what a mid-sized company where AI is applied to the marketing department would look like.

Year 1 AI Investment: $50,000

- ChatGPT Team 15 user subscriptions: $5,400.

- Claude API to personal integration: $3,600.

- Integration, setup of the workflow: $18, 000.

- Training and change management: $12,000.

- Continued follow-up and evaluation: $6,000.

- Data cleaning and data entry: 5000.

Calculated Benefits:

- Time saved through content creation: 2000 hours/year x $40/hour = 80000.

- Acceleration of deployment of the campaigns: 30-thousand dollars of accelerating the revenue recognition.

- Reduction of re-work due to quality improvements: $15, 000.

- Employee retention (prevented 1 departure): 25000.

Total Benefits: $150,000

ROI Calculation: ($150,000 – $50,000) / $50,000 x 100 = 200% ROI

Payback period: 3 months (investment corrupted by Q1)

The key insight? This staff did not simply tabulate number of hours saved. They caught process enhancements, quality award, and retention profit that almost doubled their determined ROI.

Complete AI Cost Breakdown

Categories of expenses are of importance. The majority of budget plans lack at least three of these categories.

| Cost Category | Examples | Typical Range | Notes |

|---|---|---|---|

| Subscription Costs | ChatGPT Team ($30/mo × users), Claude API, Gemini Enterprise | $2,400-$5,000 | Scales with team size and usage patterns |

| Infrastructure | Cloud hosting, GPU compute for self-hosted models | $1,000-$50,000 | Much higher for on-premises deployments |

| Data Preparation | Cleaning, formatting, labeling training data | $5,000-$100,000+ | Most underestimated cost category |

| Integration & Customization | Custom GPTs, API connections, workflow automation | $10,000-$200,000+ | Varies wildly by technical complexity |

| Training & Change Management | Employee onboarding, documentation, workshops | $5,000-$50,000 | Often forgotten entirely |

| Ongoing Support | Model updates, monitoring, bug fixes | $2,000-$10,000/year | Continuous annual cost |

| Licensing & Compliance | Data governance, security reviews, legal clearance | $5,000-$20,000 | Increases with regulatory requirements |

Year 1 Estimated cost range: $30,000 -425,000+.

Median implementation cost: $85,000

The scope is immense since the range revolves on scope. The minimal team that creates content with the help of ChatGPT is located on the bottom. A firm utilizing proprietary data mix and a custom LLM strikes the premium.

Hidden Costs That Derail Budgets

These sources are normally identified as budget overruns:

The resistance to change generates a 4-8 weeks dip in productivity as work groups adapt to new processes. That is actual output that is lost as people acquire knowledge of the tools.

Before deployment, quality assurance must have specific tests. Someone must verify AI outputs are up to standard which is time consuming and requires expertise.

It occurs due to rework and corrections in case the AI fails to hit the right target. Within the context of my experience with AI being applied to content teams, initial applications can result in output that is 20-30 percent lower than usable without human intervention.

These training cycles are not confined to pre-boarding training. The teams require continuous coaching because they find new use cases and hit edge cases.

Technical debt occurs because the integration requires support. There is change in APIs, models get updated, workflows become broken. Funds to maintain constant repairs.

The opportunity cost signifies bandwidth that is spent on other projects. Even the best performers who take two months to implement AI are not doing their high-value activities.

Hidden combined cost estimate: 20-30 of total project price.

When these factors arise, a budgeted amount of 85000 will come out costing 102000-110000.

Department-Specific Benefits With Real Numbers

Competitor-based benchmarks offer minimal values. Of importance is returns that are specific to various functions. This is what the real teams are recording.

Marketing Teams

Registered advantage: 70 times quicker campaigns implemented, 40 times large innovativeness.

Calculation method: Change in hours/month of the team x 0.7 x 12 months x hourly rate.

Scenario example: 5 marketers averaging 160hours/month, mixed rate of 50/hours.

- Time saved: 5 x 160 x 0.7 = 560 hours/month

- Annual value: 560 x 12 x $50 = $336,000

- Typical investment: $65,000

- ROI: 417%

The is the most returned after marketing is done as AI is efficient in content generation, campaign ideation, and testing variation of a campaign.

Sales Teams

Reported advantage: pipeline creation, 2-3 times, (40) cutoff sales period.

Method of calculation:(Pipeline value x opportunity volume increase%).

Model: Up to date pipeline $1M, AI lead score, and outreach doubles qualified opportunities.

- Other pipeline: $1M/2 x 200% =2M incremental revenue opportunity.

- Close rate consideration: 40 percent quicker cycles would translate to greater deals being closed on a quarterly basis.

- Typical investment: $45,000

- ROI: 300-400% (when closed revenue, and not only pipeline)

The issue with sales ROI is that AI can do work prospecting, sequencing emails, and qualifying and sale reps can work in high value relationships.

Support Teams

Benefit expressed in documentation: 337% improvement in responding.

Calculation method (Support agent salary x team size x 0.337).

Sample case: 10 support team with $50,000 benefit.

- Capacity acquired: 10 times 50 000 times 3.37 = 168500 times per annum as equivalent.

- Alternative calculation Prevented the hiring of 3-4 extra agents.

- Typical investment: $35,000

- ROI: 381%

The benefits of AI support teams are dramatic since they can process tier-1 requests, write complex cases, and offer possible knowledge base articles in real time.

Operations Teams (H3)

Recorded advantage: Cost saving in logistics and maintenance 10-20% lessening.

Factor of calculation: (Current operations cost x reduction percentage).

Hypothetical example: operations budget of $ 1M/yr (fleet, logistics, maintenance).

- Reduction of cost: 1M-0.15=150,000 annual saving.

- Sources: inventory management, predictive maintenance, Route optimization.

- Typical investment: $75,000

- ROI: 100%

Operations ROI is not as volatile and quick, appearing in fuel efficiency, less downtimes and better resource allocation.

Finance Teams

Recorded advantage: 64% cost saving in compliance processes.

Computation method: (Costs in compliance team 0.64).

Instead of example scenario: compliance budget of $300,000 per year.

- Cost savings: $300,000 x 0.64 = $192,000 annually

- Sources: Fraud detection, regulatory reporting, automated reconciliation.

- Typical investment: $95,000

- ROI: 102%

Finance The benefits of reduced manual processes, quicker month-ends and enhanced fraud detection are realized by finance. The ROI is good but 6-8 months will be required to realize it as systems become implemented with the current financial platforms.

Research Firm Based Industry Benchmarks

Examples of real-world performance data in industries are provided in Forrester, Gartner, McKinsey, and IDC research.

| Industry | Use Case | Year 1 ROI | Payback Period | Source |

|---|---|---|---|---|

| Marketing | Content automation | 200-300% | 3-4 months | Forrester |

| Support | Chatbots + triage | 300-400% | 2-3 months | Gartner |

| Finance | Invoice & reconciliation | 150-250% | 6-8 months | McKinsey |

| Operations | Route optimization | 180-280% | 4-6 months | IDC |

| Sales | Lead scoring | 250-350% | 2-4 months | SiriusDecisions |

| Legal | Contract review | 220-320% | 5-7 months | Legal Tech Today |

Winning the fastest ROI: Support and sales functions (2-4 years payback) since AI instantly addresses the matter of high-volume, repetitive duties that previously had to be handled by a human.

Longest ROI performers: Finance and healthcare (8-18 months) because of the complexity to integrate, regulatory factors, and take longer to have the available data proven.

The trend: ROI is highly associated with the amount of repetitive activities and use of imperfect outputs. Faster returns are experienced on high volume, low risk activities. The high-stake and low-volume processes are more time consuming and yet provide good returns.

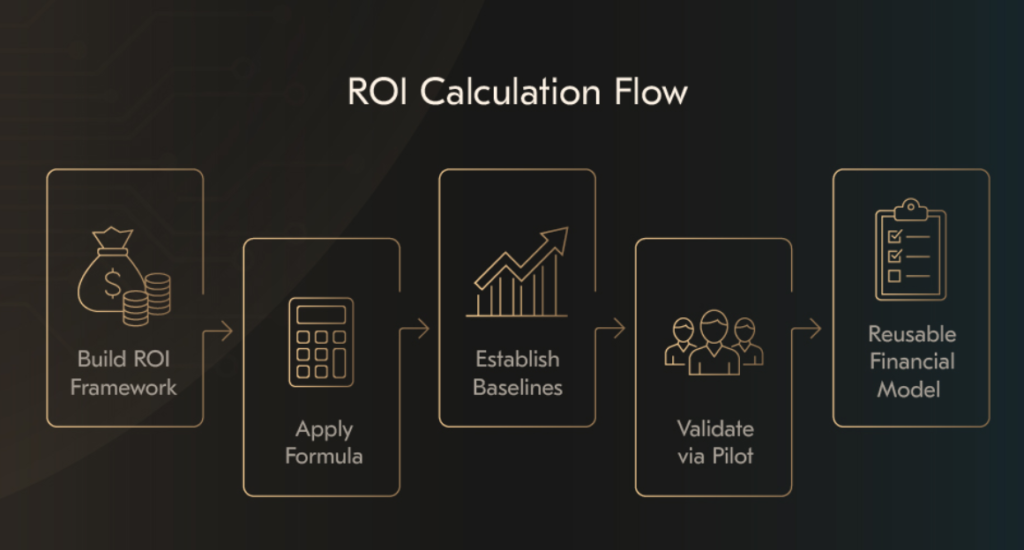

Building a Custom ROI Calculator

Average in generic industry is irrelevant as compared to organization specific computation. The following is the structure of calculating true ROI under real circumstances.

Step 1: Define Baseline Inputs

Begin with the data of the present situation:

- Department or function

- Current team size

- Present labor expense (salaries + benefits + overheads) per year.

- Selection of the AI tool ( ChatGPT Team, Claude, Gemini, custom solution)

- Main use case (content writing, customer Care, generating the code, data analysis);

- Volume of targets in one month.

Step 2: Calculate Comprehensive Costs

Work with the table of cost breakdown in the previous figure with realistic estimates:

Direct costs:

- Tool subscriptions x 12 months

- Infrastructure (where necessary)

- Integration services (vendors quotation or own IT quotation)

Implementation costs:

- x hourly rate of data preparation.

- Hours of training multiplied by the number of employees multiplied by the hourly rate.

- Direct costs Overhead project management (15-20% of direct costs)

Ongoing costs (annual):

- Support and maintenance

- License renewals

- Reviews: compliance, security reviews.

Add 25% buffer for hidden costs

Step 3: Project Benefits Across All Four Pillars

Pillar 1 – Financial:

- Time (hours on saved each week) 52 weeks x rate per hour.

- Manual process cost – automated cost volume x annual.

- Correlation in revenue through reduction in cycle time.

Pillar 2 – Productivity:

- Throughput increase percent Change in current value of output.

- Cost of defects/rework Quality improvement x cost of defects/rework

- Improvement x cost of retention per departure.

Pillar 3 – Agility:

- Time-to-market enhancement x monthly revenue.

- Quality improvement of decision (conservatively estimate)

Pillar 4 – Risk:

- Loss of compliance penalty 1 $x.

- x detection improvement percentage was not obtained due to loss of fraud.

- Cost of security breach x Risk mitigation percentage.

Step 4: Calculate Final Metrics

Total Benefits = Sum across all four pillars Total Costs = Direct + Implementation + Ongoing + 25% buffer ROI % = (Benefits – Costs) ÷ Costs × 100 Payback Period = Total Costs ÷ (Monthly Benefits)

Break-even Analysis: Find out the month with the greatest cumulative benefits greater than cumulative costs.

Sample Calculator Output

Inputs:

- Division Customer Support Division.

- Team size: 12 agents

- Annual labor cost: $600,000

- Tool: ChatGPT Team + custom integration with API.

- Use case Response drafting/ knowledge base search.

Calculated Costs:

- Subscriptions: $4,320

- Integration: $28,000

- Training: $15,000

- Ongoing support: $8,000

- Buffer (25%): $13,830

- Total Year 1 Cost: $69,150

Projected Benefits:

- Time saved (40% efficiency): $240,000

- Improving quality (less escalations): $45,000.

- Prevented hiring (2 agents): $100,000

- Total Benefits: $385,000

Results:

- ROI: 457%

- Payback period: 2.2 months

- Break-even: Early to mid February (January opening)

Three-Year ROI Projection

The ROI of Year 1 is the start. In the third year 2-3 ROI, AI implementations start to get transformational.

| Year | Costs | Benefits | Net ROI | Cumulative ROI |

|---|---|---|---|---|

| Year 1 | $85,000 | $200,000 | 135% | 135% |

| Year 2 | $40,000 (lower onboarding) | $350,000 (scale effects) | 775% | 455% |

| Year 3 | $35,000 (optimization) | $500,000 (full maturity) | 1,327% | 857% |

The reason why ROI is accelerated by a large margin:

Year 2-3 removes the costs of implementation. There is no longer anything like an integration cost, education of the entire team or project management overhead. Subscriptions and maintenance only are left.

The returns continue to increase with adoption. The early adopters familiarize themselves with the tools and tutor colleagues. Use cases go beyond scope. It is a sort of teams that find applications that no one may have intended in the beginning.

Increases in efficiency become cumulative. The saved time during Year 1 is invested into more valuable activities that would result in higher returns during Year 2.

The competitive moat widens. Firms that are savvy in AI tools are ahead of their market rivals struggling to understand fundamentals. That speed going is turned to market share gains.

The lesson? The fact that Year 1 ROI of AI projects will be 135 and not higher does not mean that organizations should give up on artificial intelligence projects. That’s table stakes. The long-term deployment of the deployment is realized in real values.

Common ROI Calculation Errors

A majority of the calculations tend to fail unpredictably. This is where projections get deviated.

Error 1: What Counts non-Labor Savings

The error: 500 hours saved are multiplied by 50/hour, which is ROI 25,000.

Reasons why it is wrong: Does not consider quality improvement, revenues, retention payoffs, and mitigation of risks.

The remedy: Utilize all the four benefit pillars. The labor savings can be along with the quality addition can be between 25,000-15,000, addition to delivery can be between 20,000-15,000 and retention can be between 30,000-15,000. Actual benefit: $90,000.

Error 2: The Underestimation of Implementation Time

The error: “We shall be trading in 4 weeks.

Reasons why it is wrong: It goes through a lengthy process of integration. Data preparation is messy. Training is a multi- round exercise. Real timeline: 3-6 months.

The adjustment: conquering timeline estimates with 25-40 pass added buffer. When the vendor quotes 6 weeks, budget 8-10 weeks. The payback period is out of control due to delayed realization of ROI.

Error 3: Forgetting The Ongoing Costs.

The error: $85,000 in Year 1, then it becomes no more than $5000/year subscriptions.

The reason why is wrong: Models must be updated. Integrations break. Teams need ongoing coaching. Actual ongoing costs: $25,000-$40,000/year.

The remedy: Project 3-Year-total cost of ownership (TCO) and not Year 1. Add subscriptions, support, maintenance and periodical retraining.

Error 4: Image Not contextually made use of Generic Benchmarks.

The error: 300% is the average ROI in marketing, and it will be the same in our case.

The reason it is not right: Benchmarks present best realizations. Definite workflows, data qualitative and change preparedness may vary greatly.

The cure: Count actual team functions, actual team costs and actual team use cases. Abuse benchmarks as tests of sanity rather than forecasts.

Monthly Supervisory Structure

Keeping a ROI on the first run and not bothering with continuous measurements is as though planning a trip to a road and forgetting all about the gas indicator. The constant surveillance is required.

Essential Monthly KPIs

Time saved metrics:

- Man hours of manual labor saved.

- Automated vs. total tasks.

- Pre/Post average time/task.

Cost reduction metrics:

- Benefit in labor costs (actual not projected).

- Process efficiency gains

- Reduction of vendor/contractor expenditure.

Revenue impact metrics:

- Transactions were more expedited with the help of AI.

- New income of higher capacity.

- Improvements through better insights in upsell/cross-sell.

Quality metrics:

- Pre post error rates before/after AI implementation.

- Reduction in the percentage of rework.

- Customer satisfaction scores (customer facing applications)

Adoption metrics:

- Team that uses AI tools as a percentage.

- Frequency of use per user

- Feature adoption rate

Customer satisfaction (where needed):

- Time of support tickets solving.

- The rates of first-contact resolution.

- Customer satisfaction 8.7502e-07202015.

Create an easy dashboard which automatically pulls these metrics. Review at the end of every month as part of team meetings. Where the numbers have gone off projections, find out reasons and change one of the implementation or forecast.

When AI Investment Doesn’t Make Sense

Other times the appropriate ROI calculation is not go ahead with this project. That is where AI investment is not justifiable.

Low-Volume, Highly Variable Processes

AI requires scale to rationalize set up expenses. When the contracts have horrible variations and the number of contracts to process annually are 20, it would be cheaper and quicker to review them by hand than it would be to design AI robots.

Thumb Tip: At least 100 repetitive incidences per month must warrant the automation effort.

Extremely High Accuracy Requirements

The accuracy of the current AI tools is 85-95 percent. That suffices in writing emails (humans do that later). That is not admissible in terms of medical dosing calculus or airplane safety tests.

When not to do it: All areas where mistakes have disastrous effects and accuracy should exceed 99.9.

Lack of Quality Training Data

Garbage in, garbage out is applied with a ruthless hand to AI. Provided that data is incorrect, incomplete or unreliable, AI will enhance those issues.

Risk indicators: Information is currently stored in incompatible data this means that major gaps have been created in the data, there are no standard procedures that can be used to create more and more similar data in the future.

Organizational Resistance Without Executive Backing

The implementation of AI needs changes in the workflow. Unless the teams willingly embrace and the leadership will not force them, the company will have wasted a new investment of $85,000 on tools that are not being utilized by anyone.

Success requirement: Executive sponsorship, mandates and non-adoption consequences.

Premature Technology in Individual Uses

Artificial intelligence is rapidly developing. In some cases 6-12-month wait can be more effective tools at reduced cost with reduced integration headaches.

Wait-time: The state-of-the-art applications that AI can hardly perform. Allow beta testing by others currently and adopt established solutions in the future.

Practical Resources for ROI Calculation

Thanks to these tools, the calculation of ROI with reference to certain circumstances in an organization is very accurate:

ROI Calculator: Google sheets template: There are four-pillar framework formulae ready to use. Cost of inputs, benefits views will give instant payback analysis in 3 years.

Scaffold Checklist: Weekly implementation plan of how AI is usually rolled out, starting with the project plan and all the way to acceptance. Helps make sensible schedules and eliminate the underestimation of the time of the actual implementation.

Benefit Quantification Workbook: Further broke down worksheets on each benefit pillar including industry related examples. Directs one in calculating benefits that would have otherwise been ignored.

Industry Benchmark Comparison: ROI of Forrester, Gartner, McKinsey, and IDC in 12 industries with 30+ cases. Compare projections with similar implementations with it.

3-Year Projection Model: Also displays how costs will reduce and benefits grow with time. Helps present the case of continued investment after Year 1.

Final Analysis on AI ROI Measurement

AI ROI does not exist as a single figure, but as four different types of benefits that will be estimated over a duration of years.

The 72 percent of companies that are not able to measure AI returns do not fail because it is unable to measure it. The reason they are failing is they track the wrong indicators, therefore they do not make investments that take into account the hidden costs and they also give up the initiatives before Year 2-3 when actual returns will become a reality.

The competitive edge of measuring better than the competition comes out of measuring better than the competitors, rather than better tools of AI access (all have access to ChatGPT, Claude and Gemini).

Organizations that closely monitor all four pillars of benefits and take into consideration realistic costs such as hidden expenses, and are willing to practice multi-year deployment will experience returns in 400 and over as competitors will fail to calculate initial investments.

I have observed that businesses that have been successful in applying AI measurement have had some common characteristics in that they begin small with pilot projects, they measure anything at all, and they scale rapidly after the initial ROI confirms the methodology. The failures of the organizations in question usually have attempted to be deployed everywhere simultaneously without measurement systems running.

The framework is available. The calculator templates are prepared. Benchmarks are documented. The path to success is based on execution, that is, the careful application of AI, comprehensive measurements, and constant optimization in accordance with the knowledge that the data provides.

Begin with a targeted pilot and rigorously test with all four pillars of the benefits and scale the success. That is how entities can use AI as an instrument to make it a competitive edge that can compound over time.

I’m software engineer and tech writer with a passion for digital marketing. Combining technical expertise with marketing insights, I write engaging content on topics like Technology, AI, and digital strategies. With hands-on experience in coding and marketing.