Last updated on December 21st, 2025 at 09:55 am

So here’s the thing: I was seeing “BNB volume bot” in crypto Twitter threads left, right and center with no idea what folks were talking about. Sounds super technical and sort of sketchy, yes? As it happens, it’s much easier than you’d expect.

Here is what it boils down to, five-style. Or at least not like you’re a person who spends 12 hours a day on CoinMarketCap.

What the hell is a BNB Volume Bot?

OK, say you have a lemonade stand. You’ve only just opened it and no one knows you are there. Passersby look at zero customers and go “bad lemonade” and keep walking.

BNB volume bot ultimately is akin to hiring numerous friends to buy and sell cups of lemonade at your stand. They’re not actually thirsty, they’re generating traffic so real customers walking by will see that it’s a busy place and think “oh, must be good.

We’re not talking lemonade but rather, crypto tokens on the BNB Chain (formerly Binance Smart Chain). And the friends, it’s robotic software in charge 24/7.

The bot trades a token with several seperate wallet addresses. This is what sets trading volume a statistic that tells us “hey, the token has some activity going on”. More volume equals you showing up on the front page of sites such as DexScreener or DEXTools, where traders search for the next hottest token.

Why Would Anyone Use This?

Here’s one thing I learnt: It has a visibility problem in crypto.

Thousands of new tokens go live each and every day on destinations like PancakeSwap. If your token trades $0, it disappears. You’re not going to appear in any filtered search results. You might have the best project in the world, but if no one can find you, it’s dead in the water.

That’s where these bots come in. They don’t magically make your token worth something they just help you show up when people are searching. Consider it crypto tokens’ SEO.

I looked into some of the case studies where project creators used volume bots and 12 holders turned to over 500 within a 48 hour period. The bot didn’t do everything they still had other marketing and community stuff happening, too but it got them on the radar.

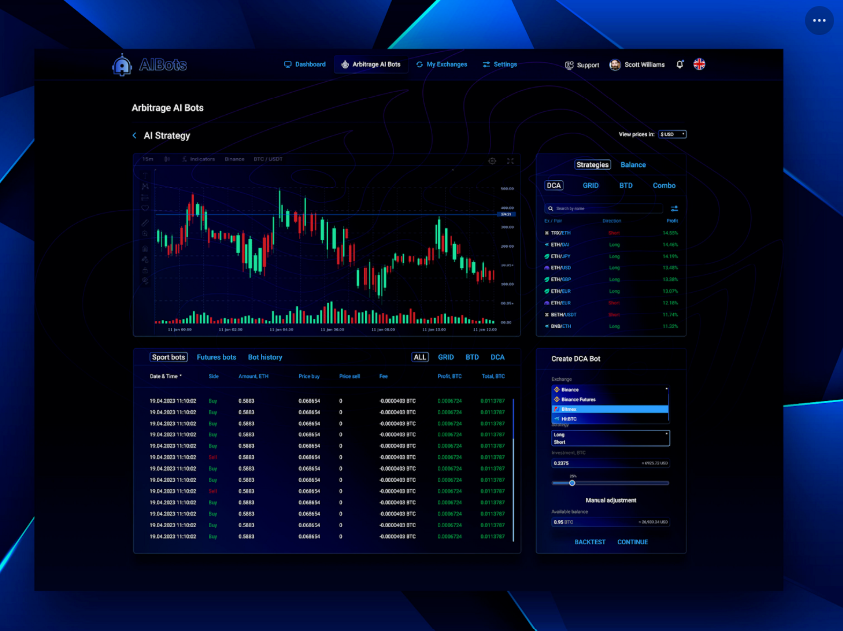

How Does It Actually Work?

This part’s actually pretty clever. The bot generates hundreds or often thousands of unique wallet addresses. Then it funnels small trades through all these separate wallets purchasing and selling the token in random amounts at random times.

Let’s assume you are looking to create $100,000 in daily volume. The bot isn’t just executing one huge trade. “You’ll never hit a bid or offer,” he explained, meaning that rather than enter one trade for $100 million or more, it will instead make hundreds of smaller trades:

- Wallet A buys 0.8 BNB worth

- 47 seconds later Wallet B sells 1.2 BNB worth

- 2 seconds later, Wallet C purchases 0.5 BNB as well

It keeps changing up the time and size so it appears as though actual people are trading. The good bots also modify the buy/sell split (something like 60-70% buys, 30-40% sells), so that the price is stable but volume is pumped.

You can also get a price range. Should the token price become too high or reach to low, the bot pause itself. The same thing if gas fees get overheated it will stop trading to be sure your budget is protected.

The Part Nobody Talks About: Is This All Right?

I’m not going to sugarcoat it, OK this falls within the gray area.

Using automation to trade? Totally legal in most places. But with the bots pushing fake volume that deceives people? That starts stepping into manipulation world, and that’s definitely not legal.

It just depends on what you do with it. If you are gamifying for pranking rankings, that is shady. But if you are using it to build an initial visibility sketch in order to complete a real project with actual value, that’s more defensible.

The regulators are for sure looking at this stuff now. They’re demanding things like unique algorithm IDs and clear tracking of bot activity.

Bottom line: all of the transactions are right there on the blockchain. Lazy bot patterns are easily detected by even most basic players. You just have to ask yourself: Are you making visibility or illusion?

What It Costs and What You Get

Registration fees generally run between 0.5-6 BNB (that’s about $300-$3,600, depending on the price of BNB). You’ll typically be looking at something with about 100K DAILY volume from that.

But here’s what people forget you also need liquidity. If you’re doing something like $100K volume, then you should probably have between $200K – $300K in your PancakeSwap liquidity pool. And if they do not, every trade moves the price so much that the whole thing collapses.

And then there are gas fees for all those transactions. BNB Chain is much cheaper than Ethereum, but if you do hundreds of trades a day it all adds up.

What you get in return: better rankings on token tracking sites, increased visibility to potential investors, and a degree of activity that makes your project appear alive. What you get: guaranteed price hikes, automatic success and no genuine community engagement.

My Honest Take

So after this rabbit hole, what I think is that volume bots are tools. As of any tool, they can be wielded well or poorly.

If you have a real project and a real roadmap and want to build something useful, maybe (a volume bot) will help people see your stuff in an insanely crowded market.” It’s like paying for ads. Not inherently evil.

But if your whole plan is “deploy bot, fabricate hype, cash out,” you’re asking for trouble. The patterns bots can’t see Smart traders are able to identify bot-patterns. Detection in platforms is improving. And regulators aren’t asleep anymore.

The best use case I’ve seen? New projects that mix bot-juiced initial visibility with real marketing, real product development, and genuine community building. The bot gets you in the door. Your response after that is what makes you a “winner” or a “loser.”

Should You Use One?

Depends. Are you promoting a token and are looking for the momentum to come up on search? Maybe it makes sense.

Do you expect a volume bot is going to suddenly moon your token? Save your money.

Are you intending to deceive investors over organic interest? Don’t even think about it.

In the fast-changing world of crypto, today’s success story could be obsolete tomorrow. Volume bots are one element in a much larger puzzle. They are not magic, they’re not a shortcut and most certainly do not bypass building something that folks actually want.

But what for utter beginners still trying to figure out what the heck people are talking about? Now you know. It’s not as mysterious (or magical) as it seems.

Read:

Best Bluetooth speakers under $50: Premium features without the price

Hi, I’m Sathosh! I write about the latest news, trends, and best picks across different categories. I enjoy simplifying information, sharing insights, and keeping readers updated with useful and engaging content. My goal is to help you stay informed, inspired, and ahead of the curve.